Read on to learn more about the importance of liabilities, the different types, and their placement on your balance sheet. In most cases, lenders and investors will use this ratio to compare your company to another company. A lower debt to capital ratio usually means that a company is a safer investment, whereas a higher ratio means it’s a riskier bet. When a company’s total liabilities exceed its total assets, it is insolvent. A solvent company is one whose total assets exceed its liabilities.

What Are Examples of Liabilities That Individuals or Households Have?

Assets are what a company owns or something that’s owed to the company. They include tangible items such as buildings, machinery, and equipment as well as intangibles such as accounts receivable, interest owed, patents, or intellectual property. A) A tax that has been paid but not yet recognized as an expense.B) A tax that will be paid in the future due to timing differences.C) A tax that is never paid.D) A tax credit available to the company.

Shareholders’ Equity Components: Common Stock, Preferred Stock, Retained Earnings, and Dividends

Because chances are pretty high that you’re going to have some kind of debt. And if your business does have debt, you’re going to have liabilities. These expenses are not considered liabilities since they represent obligations that have already been met. Accounting standards require that liabilities be reported in accordance with accepted accounting principles.

Why You Can Trust Finance Strategists

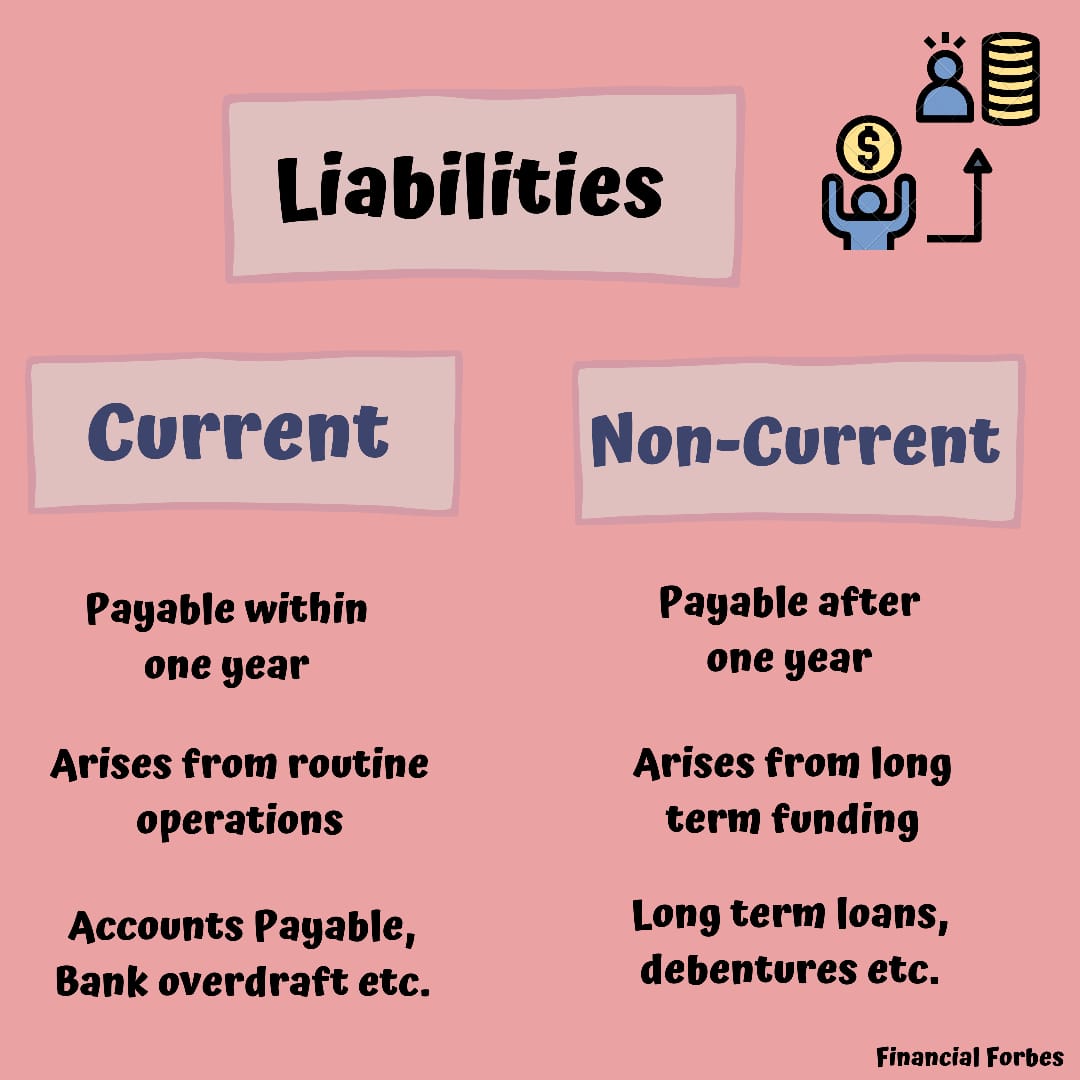

It’s important for companies to keep track of all liabilities, even the short-term ones, so they can accurately determine how to pay them back. On a balance sheet, these two categories are listed separately but added together under “total liabilities” at the bottom. Liabilities are one of 3 accounting categories recorded on a balance sheet, along with assets and equity.

What Are Liabilities in Accounting?

Risks of contingent liabilities are uncertain since they are dependent on future occurrence, and there are no interest rates until the liability occurs. Contingent liabilities examples liabilities occur as a result of uncertain future events. Liabilities work when a company realizes that there is a great need for external funding.

- Assets are what a company owns or something that’s owed to the company.

- Just as you wouldn’t want to take on a mortgage that you couldn’t easily afford, it’s important to be strategic and selective about the debt you assume as a business owner.

- Usually, you would receive some type of invoice from a vendor or organization to pay off any debts.

- For example, a bakery delivering goods to a coffee shop three times a week may choose to invoice the shop monthly instead of expecting payment during each delivery.

- A contingency is an existing condition or situation that’s uncertain as to whether it’ll happen or not.

Liabilities and equity are listed on the right side or bottom half of a balance sheet. Simply put, a business should have enough assets (items of financial value) to pay off its debt. Just as you wouldn’t want to take on a mortgage that you couldn’t easily afford, it’s important to be strategic and selective about the debt you assume as a business owner. Debt itself is unavoidable, especially if you’re in a growth phase—but you want to ensure that it stays manageable. Another popular calculation that potential investors or lenders might perform while figuring out the health of your business is the debt to capital ratio.

Liabilities are a vital aspect of a company because they’re used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. A wine supplier typically doesn’t demand payment when it sells a case of wine to a restaurant and delivers the goods. It invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant. Leases are contractual agreements that allow a company to use an asset for a specified period in exchange for periodic payments. Leases provide companies with access to assets without the need for upfront capital, making them a flexible alternative to outright purchasing.

Under accounting standards, companies must recognize lease liabilities on their balance sheets, reflecting the present value of future lease payments. Understanding the differences between operating and finance leases, as well as the implications for cash flow and financial ratios, is critical in assessing a company’s long-term obligations. Whereas liabilities are listed on a company’s balance sheet, expenses are listed on an income statement. Expenses represent monetary obligations that have already been paid. Expenses would appear on an income statement rather than a balance sheet since they are no longer a liability to the company.

Accountants call the debts you record in your books “liabilities,” and knowing how to find and record them is an important part of bookkeeping and accounting. It might signal weak financial stability if a company has had more expenses than revenues for the last three years because it’s been losing money for those years. Many businesses take out liability insurance in case a customer or employee sues them for negligence. This form of financing does not require repayment or interest payments, as shareholders assume part ownership in the company and share in its profits or losses. Equity instruments represent ownership in a company and are a primary source of permanent capital. Unlike liabilities, equity does not require repayment, but it dilutes ownership and may involve profit sharing through dividends.